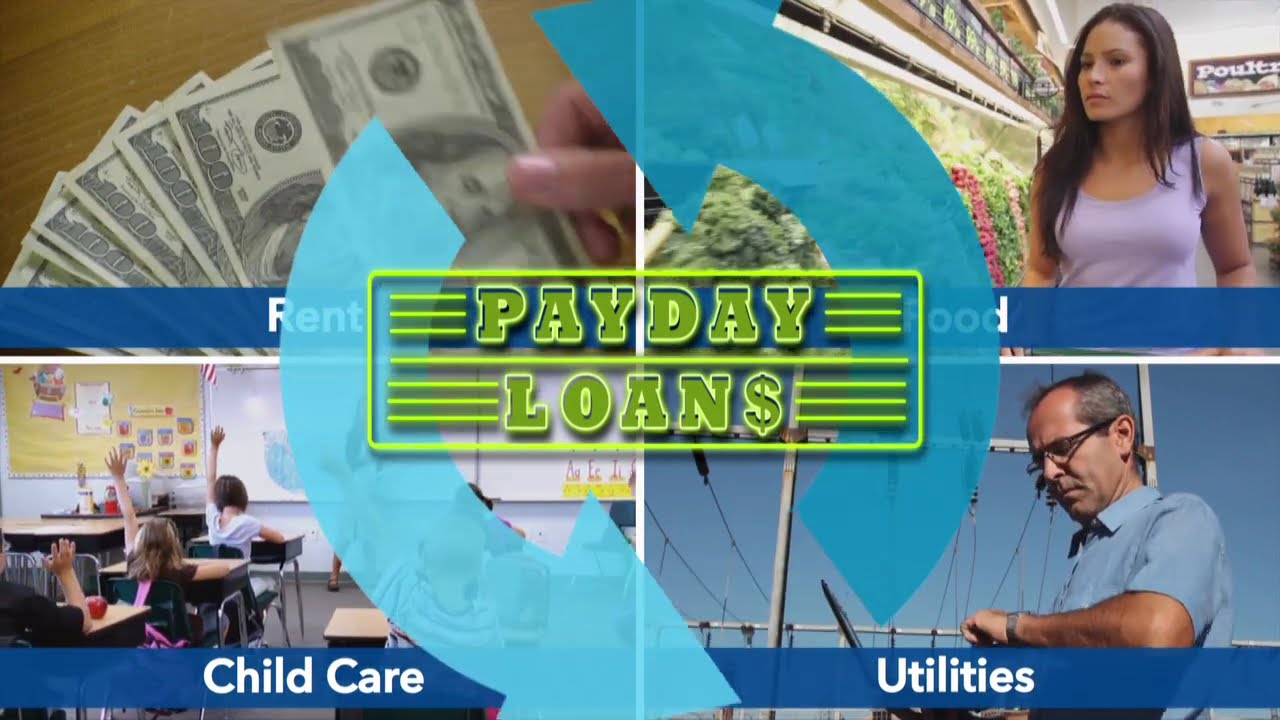

What Does Payday Loan Do?

Wiki Article

A Biased View of Quick Payday Loan

Table of ContentsThe Ultimate Guide To Quick Payday LoanPayday Loans for BeginnersPayday Loan for DummiesThe 8-Minute Rule for Quick Payday Loans Of 2022

Your company may deny your request, yet it's worth a shot if it implies you can avoid paying outrageous charges and also passion to a cash advance lending institution. Asking a loved one for assistance may be a hard conversation, but it's well worth it if you're able to stay clear of the outrageous passion that features a payday advance. Quick Payday Loans of 2022.Ask your lender a lot of concerns as well as be clear on the terms. Plan a payment strategy so you can settle the finance in a prompt fashion and avoid coming to be bewildered by the added expenditure. If you understand what you're getting involved in and what you require to do to get out of it, you'll repay your funding quicker and lessen the impact of horrendous rate of interest and also fees.

What ever before the reason you need the finance, prior to you do anything, you must recognize the benefits and drawbacks of payday lendings. Payday advance are small cash money fundings that are provided by brief term funding lending institutions. Like any kind of monetary option, there are pros and also disadvantages of payday advance. They are advertised as rapid cash advance car loans that are fast and hassle-free in these situations - Payday Loans.

Below are the benefits that customers are choosing when obtaining payday finances. With these payday advance, getting cash rapidly is a function that payday advance loan have more than its conventional rivals, that call for an application and afterwards later on a check to submit to your checking account. Both the approval procedure as well as the cash might provide in much less than 24-hour for some applicants.

Some Of Quick Payday Loan

Pay stubs as well as proof of employment are more essential to the approval of your application than your credit history. Almost anyone with a consistent task can use for a cash advance, after merely responding to a handful of inquiries. These lending applications are additionally a lot more general than standard options, leaving area for the client to be as private as they require to be concerning their loan.

A fast online loan provider search will certainly motivate you to a variety of choices for small cash money finances and rapid cash advance lendings. While there are a number of benefits and drawbacks of payday advance loan, on the internet lending institution accessibility makes this alternative a genuine benefit for those that require cash quickly. Some consumers appreciate the privacy of the internet loan providers that only ask marginal inquiries, review your earnings, and also deposit money right into your account shortly after you have electronically signed your agreement.

The Single Strategy To Use For Payday Loans

Like all excellent finance choices, there are worrying features that cancel those eye-catching advantages. As available as something like a payday advance loan is, it can be something that is as well excellent to be real. As a result of the consumers that these short-term funding lending institutions bring in, the downsides can be more damaging to these customers and their monetary states (Loans).Some consumers find themselves with rate of interest rate at half of the lending, and even one hundred percent. By the time the lending is paid back, the quantity borrowed and the passion is a total amount of two times the original loan or even more. Since these rates are so raised, customers find themselves not able to make the overall payment when the next check comes, furthering their financial debt and also burdening themselves economically.

Some of these short term lending lenders will add a fee for consumers that attempt to pay their financing off early to get rid of some of the interest. When the payday loan is acquired, they anticipate the repayment based upon when someone is paid and also not earlier in order to gather the passion that will certainly be accumulated.

If the payday advance loan is incapable to be paid in full with the following check, as well as the balance should roll over, the customer can anticipate yet one more fee that resembles a late fee, billing them more passion essentially on the payday advance. This can be burdensome for a family members as well as prevent them from having the ability to be successful with a car loan - Payday Loans.

The Facts About Quick Payday Loans Of 2022 Revealed

Many customers find these payment terms to be devastating to their finances as well as can be more of a concern than the requirement that created the initial application for the funding. Often consumers find themselves not able to make their payday advance payments and pay their costs. They compromise their settlement to the payday car loan company with the hopes of making the payment later on.

Once a debt collector obtains your financial obligation, you can expect they will call you frequently for payment via phone and also mail. Needs to the financial obligation continue to linger, these collection firms may be able to garnish your salaries from your paychecks till your unsettled debt is gathered. You can figure out from the individuals specify regulations - Loans.

Report this wiki page